New Delhi: The Board of Directors of Jindal Stainless Limited (JSL) today announced the company’s unaudited financial results for the third quarter of fiscal year 2022. JSL continued to generate profitable growth through the use of export markets while maintaining overall year-over-year sales. A sharp product portfolio tailored to market needs helps the company remain flexible and responsive to customer needs. On a consolidated basis, JSL’s revenue was INR 56.7 crore in Q3 FY 2022. EBITDA and PAT were INR 7.97 billion and INR 4.42 billion respectively. JSL’s own revenue, EBITDA and PAT increased by 56%, 66% and 145% respectively. As of December 31, 2021, the net external debt is INR 17.62 billion and the debt/equity ratio is 0.7.

New Delhi: The Board of Directors of Jindal Stainless Limited (JSL) today announced the company’s unaudited financial results for the third quarter of fiscal year 2022. JSL continued to generate profitable growth through the use of export markets while maintaining overall year-over-year sales. A sharp product portfolio tailored to market needs helps the company remain flexible and responsive to customer needs. On a consolidated basis, JSL’s revenue was INR 56.7 crore in Q3 FY 2022. EBITDA and PAT were INR 7.97 billion and INR 4.42 billion respectively. JSL’s own revenue, EBITDA and PAT increased by 56%, 66% and 145% respectively. As of December 31, 2021, the net external debt is INR 17.62 billion and the debt/equity ratio is 0.7.

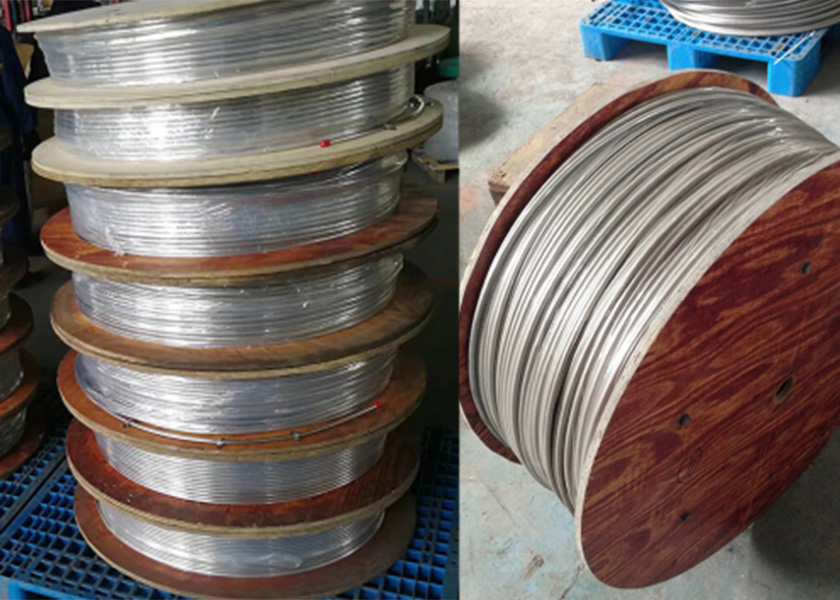

The company has maintained its strong position in the elevator and escalator segment. Taking advantage of bullish demand from the industrial and construction sectors, JSL is also working closely with various government infrastructure projects where stainless steel is the preferred alternative in life cycle costing methodologies. In an effort to increase the share of value-added products, JSL increased sales of its specialty grades (eg duplex, super austenitic) and knurled inserts. The company supplies custom and value-added grades for the Dahej Desalination Plant, Assam Bio Refinery, HURL Fertilizer Plant, and Fleet Regime Nuclear Projects, among others. However, a shortage of semiconductors in the passenger car segment and sluggish demand in the two-wheeler segment led to a slight decline in the automotive sector this quarter. The pipe and tubing segment also saw a slight decline due to lower-than-expected market demand and higher raw material prices.

In response to subsidized stainless steel imports from China and Indonesia, which have almost doubled since the beginning of the year, JSL has strategically increased its share of exports from 15% in Q3 2021 to 26% in Q3 2022. The annual share of domestic exports in sales for the quarter is as follows:

1. The impact of the moratorium on CVD on stainless steel products from China and Indonesia in the union budget for 2021-2022 has hurt the domestic industry. Imports of stainless steel flat products increased by 84% in the first nine months of fiscal year 22 compared to the average monthly imports in the previous fiscal year. Most imports are expected to come from China and Indonesia, which are up 230% and 310% respectively in 2021-2022 compared to their 2020-21 monthly averages. The 2022 budget, released on Feb. 1, again supported the removal of these tariffs, apparently to keep high metal prices down. Between July 1, 2020 and January 1, 2022, carbon steel scrap prices increased by 92% from $279/t to $535/t, and stainless steel (304 grade) prices increased by 99% – from 935 euros per ton to 535 US dollars per ton. 1860 per ton. Other raw materials such as nickel, ferrochromium and lump iron ore also rose in price by about 50%-100%. Commodity prices continued to rise in Q3 FY 2022, with nickel up 23% year-over-year and ferrochromium up 122% year-over-year. From July 1, 2020 to January 1, 2022, prices for finished stainless steel products such as 304 grade cold rolled coils increased by 61%, but this increase was lower than the 125% increase in Europe and the United States. which amounted to 73% respectively. In China, prices rose by 41%. The decision to remove tariffs will affect the survival of MSME stainless steel producers, which account for 30% of the manufacturing ecosystem, due to increased subsidies and dumped imports.

2. CRISIL Ratings has upgraded JSL’s long-term bank finance rating from ‘CRISIL A+/Stable’ to ‘CRISIL AA-/Stable’ and affirmed its short-term bank finance rating at ‘CRISIL A1+’. The upgrade reflects a significant improvement in JSL’s business risk profile and continued improvements in the company’s operating performance driven by improved EBITDA per tonne. India Ratings and Research also upgraded JSL’s long-term issuer rating to ‘IND AA-’ with a stable outlook.

3. The company’s application for a merger with JSHL is pending approval at Hon’ble NCLT, Chandigarh.

4. In December 2021, the company launched India’s first hot rolled ferritic stainless steel grating plate under the brand name of Jindal Infinity. This is Jindal Stainless’s second entry into the branded category, following the launch of the joint stainless steel pipe brand Jindal Saathi.

5. Renewable Energy and ESG Efforts: The company has successfully implemented CO2 reduction processes such as steam waste heat generation, use of by-product coke oven gas in heating and annealing furnaces, waste water recycling in industrial processes, and more steel recycling. scrap metal, and deploy electric vehicles in domestic transportation. JSL requested quotations from renewable energy suppliers upon request and received tenders, which are currently under evaluation. JSL is also looking for opportunities to produce and use green hydrogen in its manufacturing process. The company intends to integrate the strong strategic structure of ESG and Net Zero into its overall corporate strategy.

6. Project update. All projects to expand existing fields announced in Q1 2022 are on schedule.

On a quarterly basis, Q3 2022 revenue and PAT rose by 11% and 3%, respectively, due to rising global commodity prices. Although 36% of the domestic market is occupied by imports, JSL has managed to maintain its profitability by improving its product range and export planning. Interest expense in Q3 FY 2022 was INR 890 crore compared to INR 790 crore in Q2 FY 22 due to higher working capital utilization in Q3.

For 9M, PAT for 9MFY22 was INR 10.06 billion and EBITDA was INR 20.3 billion. The sales volume was 742,123 tons and the net profit of the company was Rs 14,025 crore.

Commenting on the company’s performance, Mr. Abhyudai Jindal, Managing Director of JSL, said: “Despite stiff and unfair competition for imports from China and Indonesia, a well-thought-out product portfolio and ability to expedite exports have helped JSL remain profitable. opportunities to use stainless steel to maintain our competitive edge and increase our market share in both domestic and international markets. The strong focus on financial prudence and strong operating principles have served us well and we will continue to formulate our business strategy based on market dynamics.”

After the successful launch of the flagship online portal Orissa Diary (www.orissadiary.com) in 2004. We later established the Odisha Diary Foundation and there are now several new portals such as India Education Diary (www.indiaeducationdiary.in), The Energia (www.theenergia.com), www.odishan.com and E-India Education (www. .eindiaeducation.com) is getting more and more traffic.

Post time: Jan-06-2023